Dependence on Imports in the Domestic Supply Industry Can Only Be Reduced Through National Strategies!

TAYSAD: It is Critically Important to Rapidly Develop and Support Domestic Production and Supply Strategies!

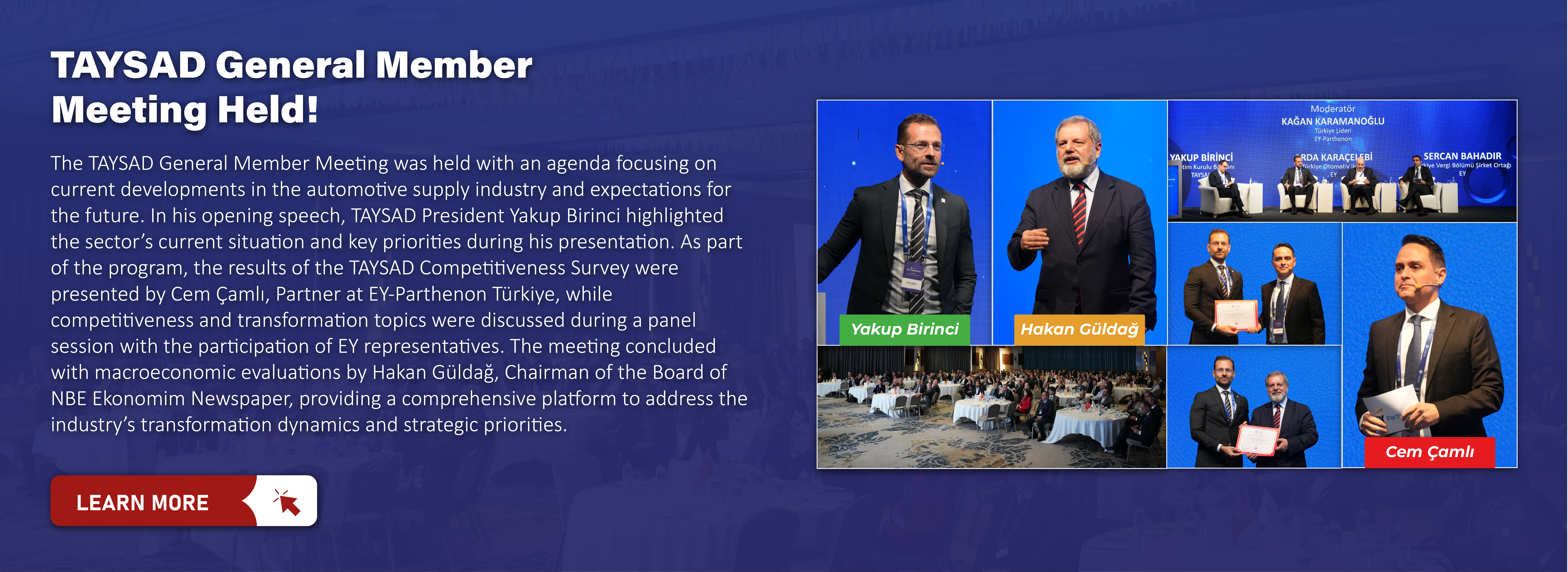

As the sole representative of Türkiye’s automotive supply industry, TAYSAD conducted a Competitiveness Survey with the participation of 225 companies to reveal the sector’s current situation and its most pressing challenges. According to the survey, the biggest challenge faced by the industry in the past two years was high labor costs, cited by 92% of respondents. Furthermore, 35% of participants reported operating below 70% capacity utilization.

Commenting on the findings, TAYSAD Chairman Yakup Birinci stated:

“The main threats to the competitiveness of the domestic supply industry are crystal clear: soaring costs, currency policies, and financial bottlenecks. These problems require urgent structural and sector-specific interventions.

According to the survey, 64% of companies experienced a workforce reduction of more than 10% in the past year, and 74% have no plans to invest in capacity expansion in 2025. In other words, 3 out of 4 firms are not planning to invest. This not only reflects the current situation but also indicates weak expectations for the future.

Additionally, there has been a significant rise in imports from China. In the long term, this could lead to production becoming dependent on imports, weakening domestic suppliers, and increasing the sector's vulnerability to external forces. Therefore, rapidly developing and supporting domestic production and supply strategies is of critical importance.”

Employment Shrinkage Continues

The survey revealed that 64% of companies in the supply industry experienced a workforce reduction of more than 10%. Only 31.56% reported no shrinkage over the past 12 months.

Meanwhile, 49.33% expect their debt levels to increase by the end of Q1 2025. One of the striking results was the response to the question, “Have you considered filing for bankruptcy protection (concordato) in the last two years?”

While no companies reported considering concordato, 34% stated that their sub-suppliers had done so, which is a worrying sign. This may reflect the perception that concordato is equivalent to liquidation and is seen as an irreversible path for companies.

In response to the question “What was your capacity utilization rate in 2024?” 35% of participants said they operated below 70%. Furthermore, 64% of companies stated they do not plan to invest in capacity expansion in 2025, and including those undecided, this figure rises to 74%.

44% of companies reported a decrease in acquiring new projects in the past year, while only 25.78% reported an increase.

Most of the lost projects were shifted to China, followed by India. The survey also highlighted a change in the direction of investment. While domestic capacity expansion slows, investment is shifting abroad. 27.23% of respondents plan to invest in facilities overseas, with destinations including the USA, China, Morocco, Romania, Germany, Eastern Europe, and Egypt.

3 Out of 4 Firms Are Not Investing!

Chairman Yakup Birinci emphasized:

“The challenges are clear: rapidly rising costs, currency fluctuations, and limited access to financing.

These must be tackled with immediate sectoral and structural reforms. The high cost of labor is not only undermining our competitiveness but also threatening the sustainability of production.

We urgently need streamlined financial support, increased SGK (Social Security) and tax incentives for skilled labor, and targeted support for productivity and digitalization investments.

One potential model could be a foreign exchange conversion support based on employment and exports. For every 100 employees, if a company reaches a designated export threshold, it could receive an additional +1 point of FX conversion support. This would help preserve formal employment and boost exporters’ appetite.”

“We must not allow long-standing and hard-earned supply networks to break under cost pressure.”

Imports from China Are Rapidly Increasing; Local Suppliers Losing Ground!

Addressing structural threats looming on the horizon, Yakup Birinci emphasized the rapid increase in imports from China:

“To compete with countries like China, we need to increase the use of local suppliers, create an incentive system based on localization, and establish fair and long-term pricing mechanisms between OEMs and suppliers.

Under Customs Tariff Code 8708 – parts and accessories for motor vehicles – imports from China increased by 156% in the last 5 years. In metal casting parts, China’s share grew by 175% in just the last 3 years.

This surge could make our industry dependent on imports, weakening local suppliers and pushing the sector's external vulnerability to critical levels. That’s why we must urgently support local production and supply strategies that reduce reliance on imports.”

TAYSAD: It is Critically Important to Rapidly Develop and Support Domestic Production and Supply Strategies!

As the sole representative of Türkiye’s automotive supply industry, TAYSAD conducted a Competitiveness Survey with the participation of 225 companies to reveal the sector’s current situation and its most pressing challenges. According to the survey, the biggest challenge faced by the industry in the past two years was high labor costs, cited by 92% of respondents. Furthermore, 35% of participants reported operating below 70% capacity utilization.

Commenting on the findings, TAYSAD Chairman Yakup Birinci stated:

“The main threats to the competitiveness of the domestic supply industry are crystal clear: soaring costs, currency policies, and financial bottlenecks. These problems require urgent structural and sector-specific interventions.

According to the survey, 64% of companies experienced a workforce reduction of more than 10% in the past year, and 74% have no plans to invest in capacity expansion in 2025. In other words, 3 out of 4 firms are not planning to invest. This not only reflects the current situation but also indicates weak expectations for the future.

Additionally, there has been a significant rise in imports from China. In the long term, this could lead to production becoming dependent on imports, weakening domestic suppliers, and increasing the sector's vulnerability to external forces. Therefore, rapidly developing and supporting domestic production and supply strategies is of critical importance.”

Employment Shrinkage Continues

The survey revealed that 64% of companies in the supply industry experienced a workforce reduction of more than 10%. Only 31.56% reported no shrinkage over the past 12 months.

Meanwhile, 49.33% expect their debt levels to increase by the end of Q1 2025. One of the striking results was the response to the question, “Have you considered filing for bankruptcy protection (concordato) in the last two years?”

While no companies reported considering concordato, 34% stated that their sub-suppliers had done so, which is a worrying sign. This may reflect the perception that concordato is equivalent to liquidation and is seen as an irreversible path for companies.

In response to the question “What was your capacity utilization rate in 2024?” 35% of participants said they operated below 70%. Furthermore, 64% of companies stated they do not plan to invest in capacity expansion in 2025, and including those undecided, this figure rises to 74%.

44% of companies reported a decrease in acquiring new projects in the past year, while only 25.78% reported an increase.

Most of the lost projects were shifted to China, followed by India. The survey also highlighted a change in the direction of investment. While domestic capacity expansion slows, investment is shifting abroad. 27.23% of respondents plan to invest in facilities overseas, with destinations including the USA, China, Morocco, Romania, Germany, Eastern Europe, and Egypt.

3 Out of 4 Firms Are Not Investing!

Chairman Yakup Birinci emphasized:

“The challenges are clear: rapidly rising costs, currency fluctuations, and limited access to financing.

These must be tackled with immediate sectoral and structural reforms. The high cost of labor is not only undermining our competitiveness but also threatening the sustainability of production.

We urgently need streamlined financial support, increased SGK (Social Security) and tax incentives for skilled labor, and targeted support for productivity and digitalization investments.

One potential model could be a foreign exchange conversion support based on employment and exports. For every 100 employees, if a company reaches a designated export threshold, it could receive an additional +1 point of FX conversion support. This would help preserve formal employment and boost exporters’ appetite.”

“We must not allow long-standing and hard-earned supply networks to break under cost pressure.”

Imports from China Are Rapidly Increasing; Local Suppliers Losing Ground!

Addressing structural threats looming on the horizon, Yakup Birinci emphasized the rapid increase in imports from China:

“To compete with countries like China, we need to increase the use of local suppliers, create an incentive system based on localization, and establish fair and long-term pricing mechanisms between OEMs and suppliers.

Under Customs Tariff Code 8708 – parts and accessories for motor vehicles – imports from China increased by 156% in the last 5 years. In metal casting parts, China’s share grew by 175% in just the last 3 years.

This surge could make our industry dependent on imports, weakening local suppliers and pushing the sector's external vulnerability to critical levels. That’s why we must urgently support local production and supply strategies that reduce reliance on imports.”